- Influenced by Karl Popper’s idea of scientific method. But disagrees in the study of natural vs. social phenomenon.

- Specifically, thinking participants. Economic theory simplifies by assuming rational behavior.

- His father escaped from Russian Revolution (与安兰德背景相似?).

- Biggest skill is skill of survival.

- From personal survival to understanding “survival of system”.

- After becoming fund manager, his philosophy becomes a handy tool, before that, he didn’t use it in daily job.

- Reflexivity := Market price always wrong, not only market participant has distorted view, but their distorted view affect future events. (Self-realizing hypothesis). Present views shape future events.

- Credit cycle – “Reagan’s Imperial Circle” 1982-1985

- Soros’ about in 1984 – https://www.georgesoros.com/1984/05/23/the-danger-of-reagans-imperial-circle/

- Reagan’s Economic Imperialism

- Budget Deficit + 高利率 + Relaxed regulation = 全球吸金

- 这种模式是有自身正反馈的

- Budget deficit stimulate econ + inflow of money -> US dollar strong + strong econ -> trade deficit (more import than export) + Strong dollar -> inhibit inflation. 结果美国经济强大,通胀不多,全球吸血.

- 让一些国家increase trade surplus, 把另一些国家吸干.

- Soros认为这种正反馈循环易于被打破,如巴西此前. Soros认为临界点是 Capital Inflow <= Budget Deficit.

- A benign circle in the center, a vicious circle in the peripheral

- Soros thinks Monetarist is wrong, there’s a non-constant relation between credit vs. econ activity

- I.e. credit used for building new factory vs. LBO is different.

- Reflexive interaction between lending & collateral value – slow boom & quick bust cycle. Bust is fast because liquidate loans make it implode.

- Regulators are also market participants – Regulatory Cycle.

- 1982 – credit expansion coming to an end, but regulators saved the market – after that the boom & bust cycle becomes more complex.

- 反对Econ中一些由公理产生的概念

- Trends (self-reinforcing), in reality, area a rule than an exception. If we believe in Econ’s independent Supply/Demand, then trends wouldn’t exist.

- 一般情况下投机性的波动会被负反馈带回原位,比如利用Supply & Demand curve会让他随着时间被修好/回平衡点. 但有例外

- 比如FX, sustained price movement will cause domestic price levels, which can be self-validating.

- 比如股票, 股票走势可能是公司强者越强.

- Credit cycle – “Reagan’s Imperial Circle” 1982-1985

- Theoretical foundation – cognitive & participating function

- “Showlace view of history” – facts -> perceptions -> facts etc.

- History is made by participant’s bias

- Not a economic equilibrium but a moving target

- Everyday event vs. Historical event

- In every day event, only participating function – cognitive function is well-defined. But historical event both in play.

- Historical event := those that change participant’s bias.

- In Econ, it assumes cognitive function is perfect knowledge.

- Soros thinks equilibrium might be OK with microeconomics, but definitely not OK for financial markets & macro.

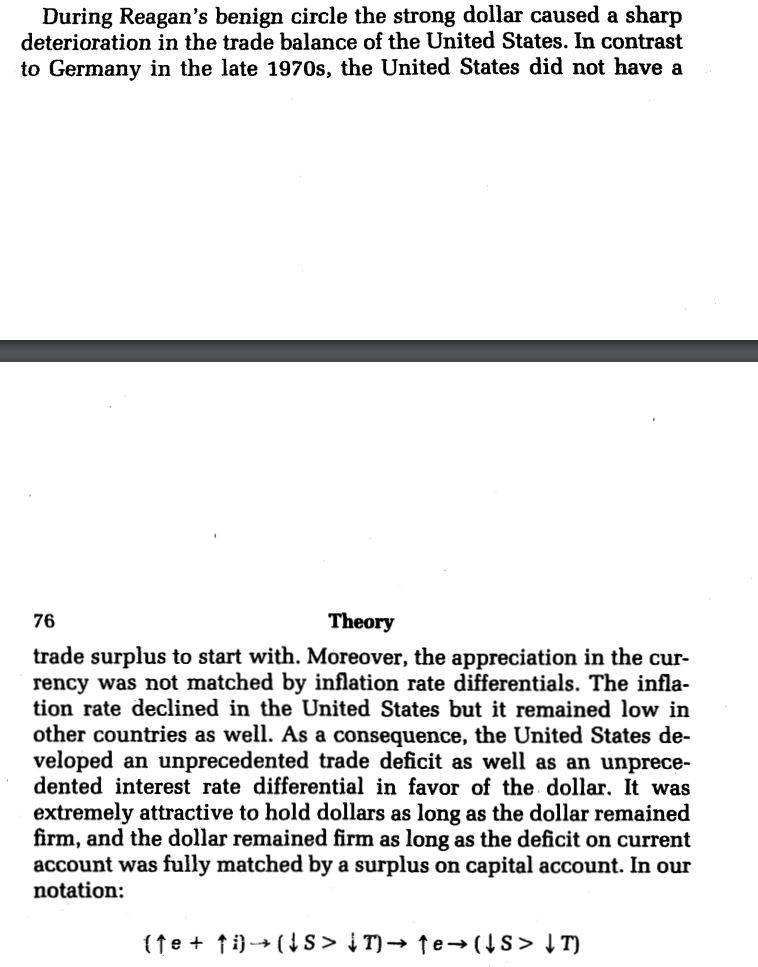

- Reflexivity in Stock Market

- Stock market is as perfect competition as you can get, yet you see almost no equilibrium

- Also totally reject EMH

- Fundamental analysis based on economics’ equilibrium idea

- Stock price affect fundamental value of the company : M&A and other corp act or credit rating etc.

- The “underlying trend / prevailing bias”

- “Typically, a self-reinforcing trend is going to have self-correction in early stage. And if it survives them, the bias tend to be reinforced, and less easily shaken. When the process is advanced, self corrections are scarcer and danger of climactic reversal greater. “

- Boom-bust sequence crude model: beginning of trend, successful test, growing conviction, widening divergence between reality & expectations, flaw in perceptions, climax. Then trend in the other direction.

- Conglomerate boom in late 1960s – people’s bias is to value EPS, but some EPS are bad – like EPS from acquisition

- Textron, Teledyne, Ling-temco-vought

- “go-go fund manager” / “gun-slingers”

- Climactic event: Saul Steinberg acquire chemical bank

- Plot example: LTV corp / Ogden Corp / Teledyne Inc. between 1961 to 1972

- REIT

- Special vehicle – can distribute income free of taxation if they distribution all income

- Boom & Bust playbook for mortgage trust (which provides construction loans for builders)

- Stock market is as perfect competition as you can get, yet you see almost no equilibrium

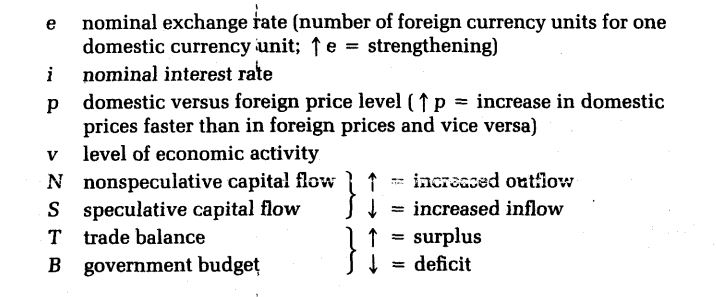

- Reflexivity of Currency Mkt

- In stock market, reflexivity is intermittent, in FX, it’s continuous and the unstability accumulates till free-floating system breaks

- Circular (not unidirectional) relation between domestic inflation & international exchange rate

- Not cause and effect, but benign & vicious cycle

- Vicious cycle: Currency depreciate + inflation increase, benign is vice versa

- Speculative Capital Movement as agent: trade surplus / deficit etc.

- Rules:

- Trade Deficit / Capital outflow -> Exchange rate decrease

- 注脚: How trade deficit cause exchange rate decrease?

- https://www.investopedia.com/ask/answers/041515/how-does-balance-trade-impact-currency-exchange-rates.asp

- For example, let’s say that candy bars are the only product on the market and South Africa imports more candy bars from the U.S. than it exports. As a result, it needs to buy more dollars relative to rand sold. South Africa’s demand for dollars outstrips America’s demand for rand.

- https://www.investopedia.com/ask/answers/041515/how-does-balance-trade-impact-currency-exchange-rates.asp

- 注脚: How trade deficit cause exchange rate decrease?

- Speculative Capital attracted by rising exchange rates / interest rates.

- Trade Deficit / Capital outflow -> Exchange rate decrease

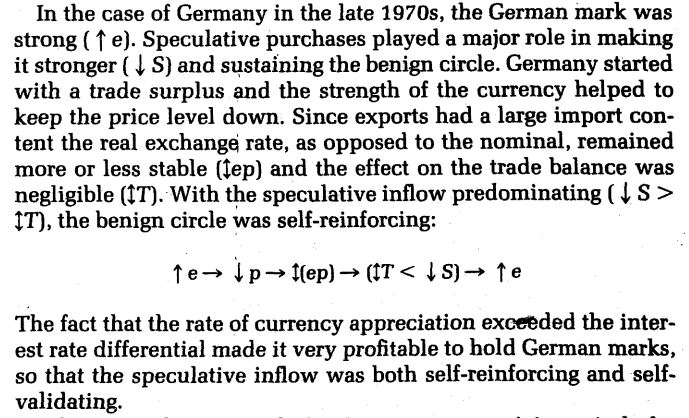

- Example: German Benign Cycle

- Example: Reagan Benign Cycle

- Credit/Regulatory Cycle

- Boom bust is usually asymmetric cycle – i.e. slow boom fast bust. But in currency market, the movement is more wavelike / symmetrical.

- Asymmetry from the reflexive relation between loan & collateral – equivalently, caused by credit

- International Debt Problem

- International lending boom starting with oil shock 1973.

- “The case for growth banks” – banks were considered rigid, frozen for regulation (due to 1930s crash) at the time. Example regulation: illegal to expand across state or open new branches.

- New breed of bankers coming to the “dull industry with dull people”.

- Oil Shock in 1973, inflow of capital to oil producing countries, they don’t know what to do with it, so deposit it with banks (petrodollars).

- So bank become more aggressive in lending practice.

- Boom half: Oil shock -> oil country has money -> bank excess deposit -> developing countries lend from commercial bank rather than IMF

- Bust half: Strong dollar making balance sheet of country worse, making bank’s balance sheet worse (in terms of credit worthiness)

- Competition among commercial bankers cause the boom-bust are doomed to happen. Competition among central banks cause the loss of regulation (didn’t regulate timely enough) for this event (Central banks don’t want their underling banks to lose business).

- Collective System of Lending

- Willingness to lend & ability to payback – has positive feedback – can cause virtuous / vicious cycle.

- Four phases of adjustment after collapse of voluntary lending for heavily indebted countries

- Reagan’s Imperial Circle

- Supply-side economist – cut tax is good!

- Reflexive reasoning regarding cut tax -> more revenue -> more tax

- Monetarist : control money supply to control inflation

- Budget deficit + monetarist tight money-supply -> uber-high interest rate -> strong dollar -> all the good things happen to US!

- Supply-side economist – cut tax is good!

- Evolution of Banking System

- Banking Crisis 1984

- Continental Illinois Bank

- Financial Corp of America – Charles Knapp – exploit the loophole of regulator bailouts – chase high interest on upside, bailout on downside

- Regulator lags after the event, 且矫枉过正

- Bailouts are often arranged by regulators as “big company” acquire “small company” – more “fragile” (in Taleb’s anti-fragile sense).

- The Oglipolarization of America

- “Mergermania”

- 现金牛公司的收购 – 一种类似于BRRRR循环的东西.

- High real interest rate -> Put money into financial assets rather than expand physical assets

- 与此同时,实业不能扩张,而是缩减+省钱

- In Social Science, it’s not “fact -> fact” but “fact -> perception -> fact”.

Twitter论述

-

反身性笔记: 反身性认为资产价格并不是未来的折现,而是市场参与者每个人的偏见产生未来. 如果许多市场参与者是群羊的话,那反身性就是一种牧羊人的方法论. 比如索罗斯做空东南亚货币时频繁接受媒体采访. 又如CZ用个人影响力干掉FTX.Side Note: 索罗斯他爸与安兰德有什么共同点? 都是192X 年葱苏俄润走的犹太人.而索罗斯定义自己最强能力是生存能力 – 他爸从苏俄西伯利亚集中营逃走,以及他从小从纳粹手中逃走练就的生存能力. 对于他的交易哲学,这种生存能力从自己的生存本能演化到对一个外在系统能否生存(是否会盈不可久/亢龙有悔)的专注研究 – 比如他1984年对里根政府经济帝国主义的研究.索罗斯对两种事件的定义: 历史事件 vs. 日常事件, 这两种时间的区别是有没有让市场参与者的cognitive bias产生变化. 对于日常事件来说市场参与者只有执行函数,但对于历史事件来说还有在此之上的认知函数. 而这种认知函数与执行函数的动态演化而非静态平衡就是”趋势”.在股票中,传统价值投资理论认为基本面决定股价,而反身性认为股价也决定基本面 – 通过credit rating, 一级市场回购等操作. 一个正反馈趋势有这样几步:1. 小趋势有苗头;2. 经过市场self-correction测试;3. 测试通过后用户渐渐有conviction; 4. 预期远高于现实; 5.顶点;6.破灭;反身性理论哲学上可以看成是一种对正反馈的觉察, 别于传统因果. 比如,不问先有鸡还是有蛋,而是蛋与鸡形成一种良性循环. 复利是世界第八大奇迹,而复利的背后是一种滚雪球正反馈. 反身性的趋势投资是观察正反馈以及何时这种反馈会亢龙有悔. 看到一对能正反馈的变量,就像干柴烈火.反身性的boom-bust sequence历史1: 1973年第一次石油危机使中东国家资本涌入,导致中东把热钱存入银行之后银行得赶紧把钱借出去,导致发展中国家向商业银行而不是IMF借钱 (当时Citi bank巴西收入占四分之一). 而后美元走强,发展中国家内忧外患信用评级下降,商业银行借给主权国家的债就不值钱了.索罗斯对这段事件的几个观察: 1. 从商业银行借钱的发展中国家花钱不当,如巴西修面子工程如Itaipu Dam, 阿根廷与智利维持高汇率,而当时巴西/智利被当成经济奇迹. 2. 当时银行已经被认为是充满监管(从1930s大危机之后), 比如跨州扩张银行/开分行有诸多限制,但依旧无效.Merger-mania(里根及之后时代 – 大肆进行杠杆收购): 如果一个公司是现金牛的话,杠杆收购并用被收购公司的现金流支付杠杆的本息,同时保持一个正向的自由现金流. 等贷款还清了,再把公司上市一遍实现资本增值,然后开始LBO下一个标的. 这和对于正向现金流的房子进行BRRRR有很大的相似之处.